investment thesis

Sony (NYSE:SONY) is a high quality value stock and we believe it is grossly undervalued by the market. The company’s operations are broadly diversified and have proven to be resilient amid the current macroeconomic challenges. The company holds leadership positions in several markets simultaneously, it has strong pricing power and a loyal audience. We give Sony Buy status at current prices.

Gaming and Electronics Market Leadership

Sony is a widely diversified company. The company has six major divisions that produce completely different products, but the most recognizable is the PlayStation console.

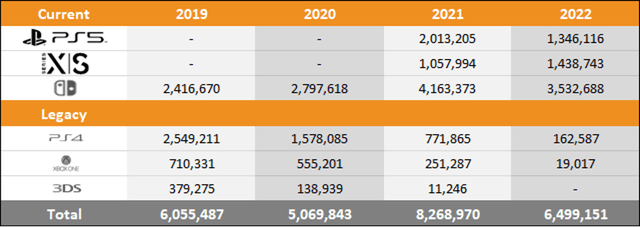

Video games have become a popular leisure activity and are popular with both children and adults. According to VGChartz, previous PlayStation generations have vastly outperformed their competitors due to the large list of exclusive games. Competition in the video game market has increased significantly with the arrival of the next generation of consoles (PS5, Xbox One/X, Nintendo Switch). There are much less exclusive games and many games have been released on alternative platforms.

Nevertheless, PS5 consoles remain in high demand even though they are in a higher price range than their closest competitor XBOX. With nearly 30 years of PlayStation presence on the market, Sony has managed to build a very large loyal customer base, so we think this trend will continue in the future. Even with the loss of some audience in favor of Microsoft or Nintendo, PS5 sales remain strong.

hapabapa VGChartz

An important part of the company’s strategy is acquiring game studios and working on its own projects. At the same time, Sony has a large sales volume, for example, in the first half of 2022, games from Horizon and Gran Turismo franchises have been ranked 4th and 7th in the US, according to NPD Group.

NPD group

We are optimistic about the future of Sony. The company has already implemented many successful projects, several famous teams are working under its care, so Sony will most likely maintain its dominant position in the video game market.

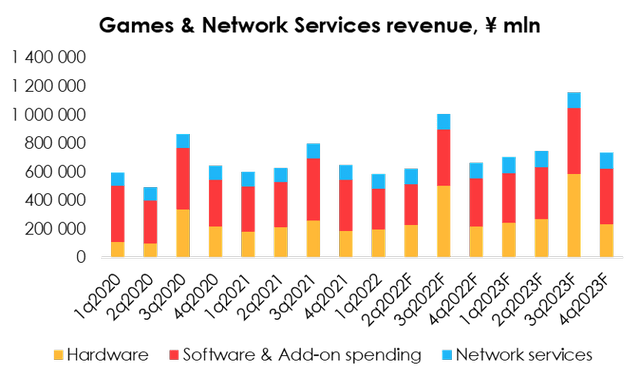

The current situation leaves much to be desired as the exit from the pandemic is still manifesting itself in a decline in MAU and user spending on content, but we expect activity to recover in 2023-2024 with the release of new games, which are positive. effect on turnover.

Invest heroes

CMOS is the diamond in the rough

By associating Sony more with the home electronics and gaming industries, investors are leaving out a very interesting segment: Image & Sensing Solutions.

The company’s management has pursued an active investment policy in the I&SS division in recent years and it seems that the investment is starting to pay off.

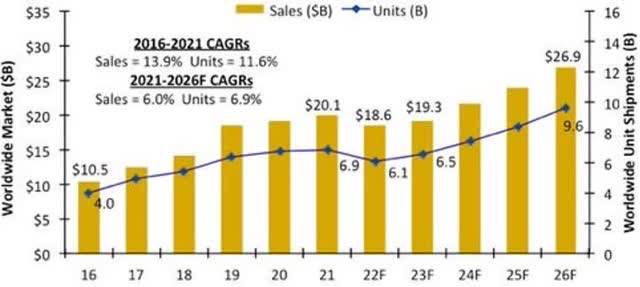

Conventionally, Sony CMOS have been mainly used in photo, video equipment and mobile phones, and the company has never lost out to competitors in sensor sales. While SLRs have lost their former popularity among the average consumer, the overall sensor market is expected to grow at a steady 6.0% year over year according to IC Insights and Yole forecasts. We think the market has a slightly higher potential. Strong sales will be driven by the trend of installing multiple cameras in mobile phones, as this is one of the major industries using CMOS, as well as the development of autopilots and driver assistance systems.

IC insights

The use of sensors is not limited to cameras and telephones. According to management, Sony is still not using full production capacity in its IS&S division, but sales in the segment are increasing by 10% year-on-year. Demand for Sony products followed a decline in demand for industrial equipment and security cameras. The process appears to be cyclical. As the construction and recovery of the industrial sector accelerates, Sony will again increase production capacity, and future increases in self-driving vehicles will support the division’s growth.

That said, the industry is generating normal operating margin even at lower volume. In a conservative scenario, we expect this to be 12.4% in fiscal 2022, increasing to 13.9% in fiscal 2023.

So we have a leader in a narrow and popular market with good prospects. Although the segment accounts for just over 10% of Sony’s total sales, we believe it has huge investment potential and is positively reflected in the fair valuation of the entire group.

valuation

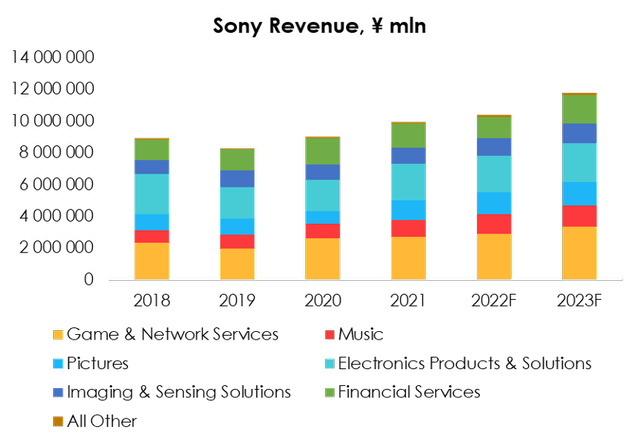

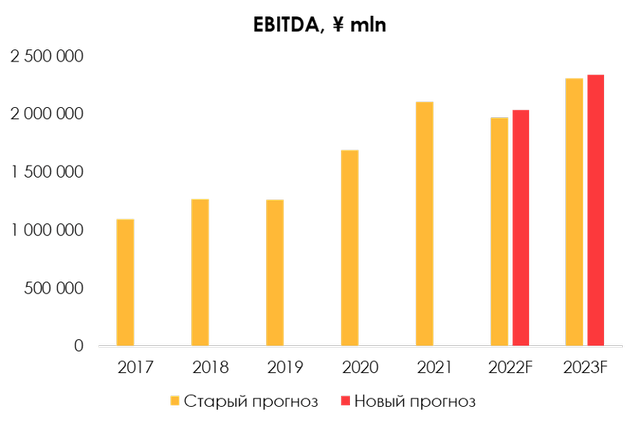

According to our estimates, Sony’s revenue will total 10 380 billion in fiscal 2022 (+4.6% y/y) and ¥11 758 billion in 2023 (+13.3% y/y), EBITDA will be ¥2 035 billion ( -3.4% y/y) and ¥ 2 340 billion (+15.0% y/y), respectively.

Invest heroes Invest heroes

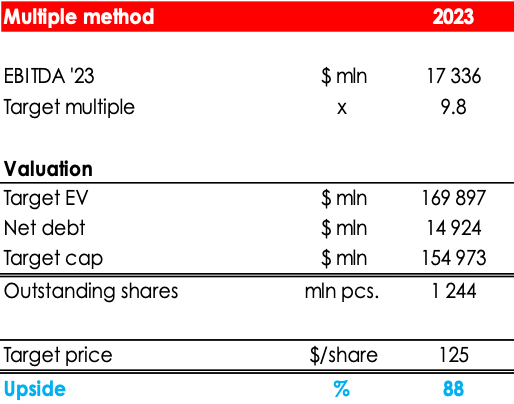

At current valuations, Sony is trading at 6.5x EV/EBITDA’22 and 5.7x EV/EBITDA’23, which is cheap given the company’s strong market position. For our valuation, we took the industry median of 9.8x EV/EBITDA’23 discounted at 13%.

According to our estimates, the NAV of Sony stock is $114 and we maintain buy status. Upward – 71%.

Invest heroes

Sony has one of the leading positions in the game console market, has a wide range of exclusive content and has managed to attract a loyal audience over the years. The company’s activities are well diversified. In addition to consoles and games, Sony produces consumer electronics, video cameras, films and owns the largest recording studio. The company continuously invests in its development and grows both organically and by acquiring small promising companies.

Conclusion

We believe that Sony has great potential. It is a high-value value stock with a leading position in many markets. Sony generates stable EBITDA and FCF, from which it also pays dividends and buys back shares. The defensive features and broad diversification of this company will keep it out of serious trouble, so with the shift in its economic agenda, Sony will be one of the first companies to grow.

We maintain buy status and believe it is reasonable to take a position in SONY stocks now, but are doing it in parts as there are signs of further declines in major stock indices.

To administer the feature, we recommend paying attention to financial statements and industry research (e.g. NPD, VGChartz, Counterpointresearch).

0 Comments