Video game stocks are in a vicious bear market these days alongside almost everything else. So in this piece, we’ve used TipRanks’ comparison tool to look at two video gaming juggernauts – EA and TTWO – who seem to have factored too much recession risk into their stock prices. With all the consolidation in the industry we’ve seen in recent years, I wouldn’t be surprised either if one of the two stocks is gobbled up by a company looking for a gaming splash. Of the two stocks, analysts are the most optimistic about TTWO, but let’s dig deeper.

While video games are often seen as “nice to have” in times of economic turbulence, I consider them to be one of the most affordable forms of hourly entertainment. In simple terms, games are a great value proposition for consumers who want to be careful about their spending.

Game consoles may be a hefty outlay, but gamers who finally get their hands on the latest Xbox Series X or PlayStation 5 are eagerly awaiting the latest batch of next-generation titles.

The video game market is indeed growing quite fast. The looming recession has taken a step out of video game stocks. However, it seems that too much pessimism has been ingrained, as a recession-induced rise in unemployment could pave the way for consumers to replace “going out” with staying in and playing a game. Without further ado, let’s take a look at EA and TTWO.

Electronic Arts is one of the oldest gaming juggernauts out there. The company, known for its annual sports titles, has seen its stock hit a wall in recent years. The stock has been stuck in a $120-140 consolidation channel since mid-2020.

It’s not easy to thrive in gaming. As with big-budget movies, there’s a big risk of spending big for a title that isn’t even guaranteed to attract a huge audience. With disappointing titles like Battlefield 2042companies like EA will definitely think twice before committing to new projects.

Indeed, taking risks on big budget titles can reap huge rewards (think hit game) Apex Legends), but it has proven difficult to stay on the content publishing wheel these days, especially with growing competition from gaming giant Microsoft (NASDAQ: MSFT).

Given the volatile nature of gaming, the market seems to favor companies with the deepest pockets and the fewest to lose. Now EA is no slouch, with a market cap of $34.1 billion. However, it may end up being in better hands under the umbrella of a tech or media giant.

Even without an admirer, EA is penetrating the burgeoning mobile games market with its hit title, Apex Legends. Furthermore, EA itself has participated in industry-wide consolidation – with Codemasters and Glu Mobile.

The future is rather hazy, especially if Microsoft continues to spin and trade in the gaming space. Anyway, EA stock is priced with not much in mind.

The stock is trading at 39.1x lagging earnings and 4.8x revenue. The multiple seems rich in relation to its growth, probably because of the scarcity premium (the number of listed gambling stocks has fallen) and the market growth potential in gaming.

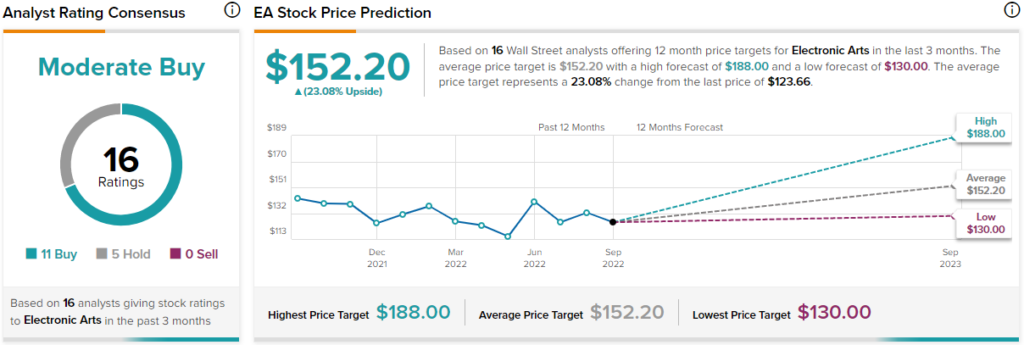

What is the price target for EA Stock?

Wall Street remains bullish on EA stocks with a Moderate Buy rating. EA stock’s average price target of $152.20. That represents a 23.1% increase from current levels. An impressive profit for a company that would be a very attractive takeover target for any heavyweight in the entertainment industry.

Take-Two Interactive stock has been decimated in recent years, now more than 43% lower than its all-time high, just $215 a share. While there have been a handful of intriguing titles such as Tiny Tina’s Wonderland to keep gamers busy for the highly anticipated Grand Theft Auto (GTA) VIClearly, investors just can’t wait any longer.

With a reported budget of $2 billion for GTA VI, it certainly seems that Take-Two puts the most eggs in one basket. That is not a good thing for an investor. Anyway, I consider TTWO stock a cheap high-upside game for those who want to be patient.

As I noted in an earlier piece, GTA VI can’t afford to rush production and risk a rocky launch day. Budget overruns and delays wouldn’t surprise me. However, such setbacks could put even more downward pressure on the stock. Anyway, GTA seems like one of the few franchises that is almost guaranteed to be a huge success once it’s done.

Like EA, Take-Two is eager to diversify into mobile. The Zynga deal gives Take-Two a nice foothold in the mobile gaming scene. While Zynga and other titles may fuel a rebound in TTWO stock, GTA VI still looks like a “make or break” for the company.

Industry insiders are pinning a GTA VI launch in the 2024-25 range. That’s a long wait in a stock that doesn’t seem to be taking a break. However, with only 5.3x sales, I think the stock is so depressed that it could come under its own feet well before GTA lands.

What is the price target for TTWO shares?

Wall Street remains patient with TTWO stocks, which have a ‘Strong Buy’ rating. TTWO’s average price target of $166.15 implies a 36.9% increase for the coming year. That’s a solid profit for a company that’s likely to be much higher in three years’ time.

Conclusion: Wall Street Expects Higher Upside Potential from TTWO Shares

EA and Take-Two are under pressure, but their long-term outlook looks solid. Both companies have full pipelines and robust mobile businesses. Between the two names, Wall Street prefers Take-Two stocks.

Revelation

0 Comments