German gamers spent more on video games, hardware and accessories in 2021 than in any year before, totaling €9.8 billion.

This figure was revealed by the 2022 annual report of Game, the trade organization for the German games industry, which showed that revenues for games products increased by 17% from already breaking levels in 2020.

As such, Germany remains the largest video game market in Europe and the fifth largest in the world.

The German games market

income

Software: €5.4 billion, up 19% year-on-year

Hardware: €3.6 billion, an increase of 18%

Online and subscription services: €719 million, an increase of 4%

Software revenue — including full game sales, in-game purchases and subscriptions, and add-on content — naturally remains the biggest driver behind spending, with most Germans buying their titles digitally. In fact, six out of ten games sold in Germany are downloads.

Key areas of growth included in-game and in-app purchases, up 30% year-over-year. The bulk of this has come from mobile, which brought in €2.76 billion (compared to the €1.5 billion spent on in-game purchases of PC and console titles).

In 2016, total software revenues were about €2 billion – a third of what they were in 2021

Mobile grew 22% overall, with revenues of €2.78 billion, as did PC accessories. Greater growth was seen in hardware revenue, up 23% year-over-year, although Game believes this would have been significantly higher had it not been for delivery bottlenecks and delivery issues, including for the latest consoles.

Online and subscription services grew less than 5%, but it’s worth noting where that growth came from. While traditional online subscriptions like Xbox Live Gold and Nintendo Switch Online saw a slight drop in revenue – from €439 million in 2020 to €437 million – library-like services performed much better.

This category of subscription services, including Xbox Game Pass, Apple Arcade and Google Play Pass, saw revenues grow by more than 21%, from €181 million to €220 million.

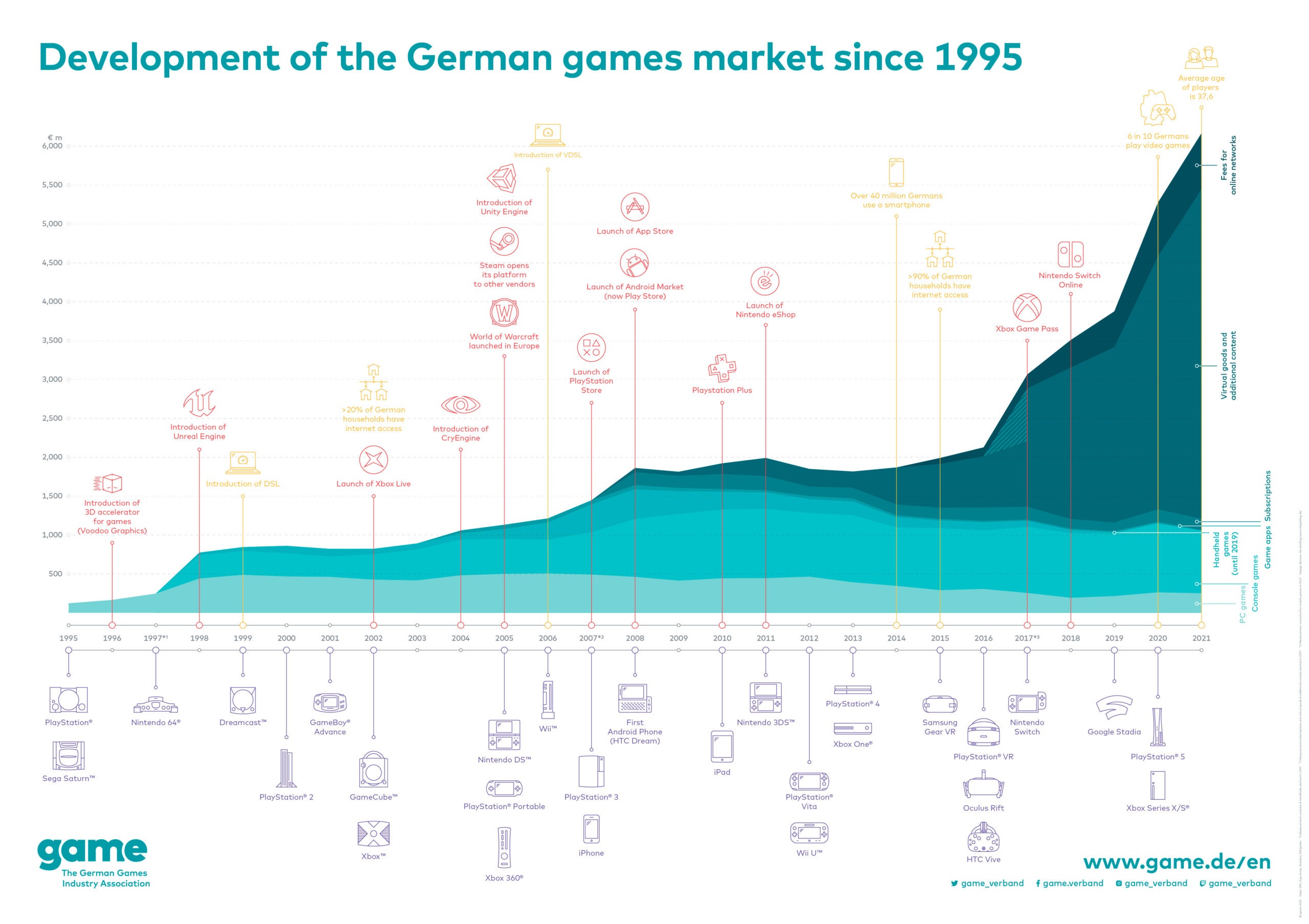

A chart at the end of the report shows how much the German game software market has grown since 1995, especially over the past six years. In 2016, total revenues were around €2 billion – a third of what they were in 2021.

Game also released updated statistics on the gaming demographics in Germany in 2022. 59% of the population between the ages of six and 69 plays video games – that’s 6% more than in 2019 and a new record for Germany.

The trade association reported that 48% of these players were women, while 52% were men, and the median age was 37.6 (up from 37.4 in 2020). Interestingly, 50- to 59-year-olds were one of the largest groups, accounting for one in five German gamers.

Most Popular Platforms

Smartphone: 23.5 million (up 4%)

To console: 17.8 million (+4.7%)

pc: 14.3 million (5.9% down)

Tablet: 10.7 million (+ 8%)

Best-selling games of 2021

- FIFA 22 (Electronic art)

- Grand Theft Auto 5 (Rockstar games)

- Mario Kart 8 Deluxe (nintendo)

- Farming Simulator 22 (Giant Software)

- Minecraft (Mojang/Microsoft)

- Super Mario 3D World + Bower’s Fury (Nintendo)

- FIFA 21 (Electronic art)

- Mario Party Superstars (Nintendo)

- Ring Fit Adventure (nintendo)

- Call of Duty: Black Ops – Cold War (Activision Blizzard)

The German games industry

Total number of companies: 786 companies, up 5% (26% over two years)

Total number of employees: 28,650, up 5%

There will be 786 companies developing or publishing video games in Germany by 2022. Most – 392 in fact – do both, while 358 only develop video games and 36 only publish. The number of publishers and companies that both develop and publish grew by approximately 14%, while the number of dedicated development studios decreased by 3%.

Most companies remain small in size: 70% of German companies employ less than ten people.

It was also reported that 47% of games produced in Germany are exported, compared to 7% film and TV, 9% books and 10% music.

While the total number of game companies is only moderately higher, 5% more than in 2020, Game reports that this figure has increased by 26% in the past two years.

Meanwhile, the total number of employees brings German industry back to around the 2020 level, where there were 28,235 employees. This figure fell by 4% in 2021, probably due to layoffs and other effects of the pandemic, but at 28,650 in 2022, the market appears to have recovered.

“We have made tremendous progress in recent years to make Germany a prime location for the games industry”

Felix Falk, Game

11,242 of these employees make up what Game calls the ‘core industry’, that is, development and publishing companies. This is 3% higher than in 2021 and 12% higher than in 2020.

Meanwhile, the expanded market — which includes service providers, retailers, educational institutions, media, and so on — is up 6% year-over-year to 17,048 people.

Game drew attention to some of the diversity aspects in the industry, with 25% of all employees being women, which is much higher than in other sectors of the digital economy, according to the trade association.

Finally, 27% have no German citizenship, compared to 17% in other cultural/creative sectors.

In his opening commentary, Game Director Felix Falk said: “With federal games funding, the government games department, games strategy and countless improvements at the state level, we have made huge strides in recent years to make Germany a prime location for the games industry.

“But Germany is still lagging behind other gaming locations – countries like France, Canada and England started providing strategic support to their games industry many years ago. If we want to fully exploit the cultural, economic and technological potential of the games industry in Germany we still have a lot of work ahead of us.

“The German games industry expects good things from this new federal government, as our game industry barometer indicates. The country is therefore in a strong position for further positive growth.”

0 Comments