In general, we like to think we know how much something is worth. The decision is based less on logic and more on emotion, an elusive gut feeling. When it comes to video games, we know when a game is under, or in most cases, overpriced. Unfortunately, that aptitude in pinpointing price to value is distorted by inflation.

Inflation has recently become a serious problem worldwide. No country is immune and there is a real fear that higher interest rates, reduced demand and austerity could lead to stagflation or worse, a global recession. Reports of stable goods rising in price become a daily occurrence.

At the time of writing, inflation in the UK is at a four-decade high and just south of breaking the double digits. We see the effects of inflation everywhere. Raw material and food prices have all risen. McDonalds has raised its prices for the first time in 14 years. Amazon Prime will raise its price for the first time in eight years. Even technology, which usually sees prices fall over time, is not immune. Meta has announced that it will increase the price of its two-year-old Quest 2 VR headsets by $100 (although there are reasons other than inflation specific to Meta’s company why it’s doing this).

What about video games? Besides collectors of retro video games and consoles, you know there’s a problem when the price of older video game technology rises. Can we see the $69.99 price tag for new PS5 and Xbox series games get higher? So far, that’s not the case, but anything is possible. If energy costs and the cost of goods continue to rise, how long will publishers absorb rising production prices before passing it on to you and me?

Unfortunately, this article can’t answer those questions, but it got me thinking: how expensive are video games these days? Let’s drop that elusive gut feeling for a while and get to work with hard facts and figures. How expensive are new games today compared to the past?

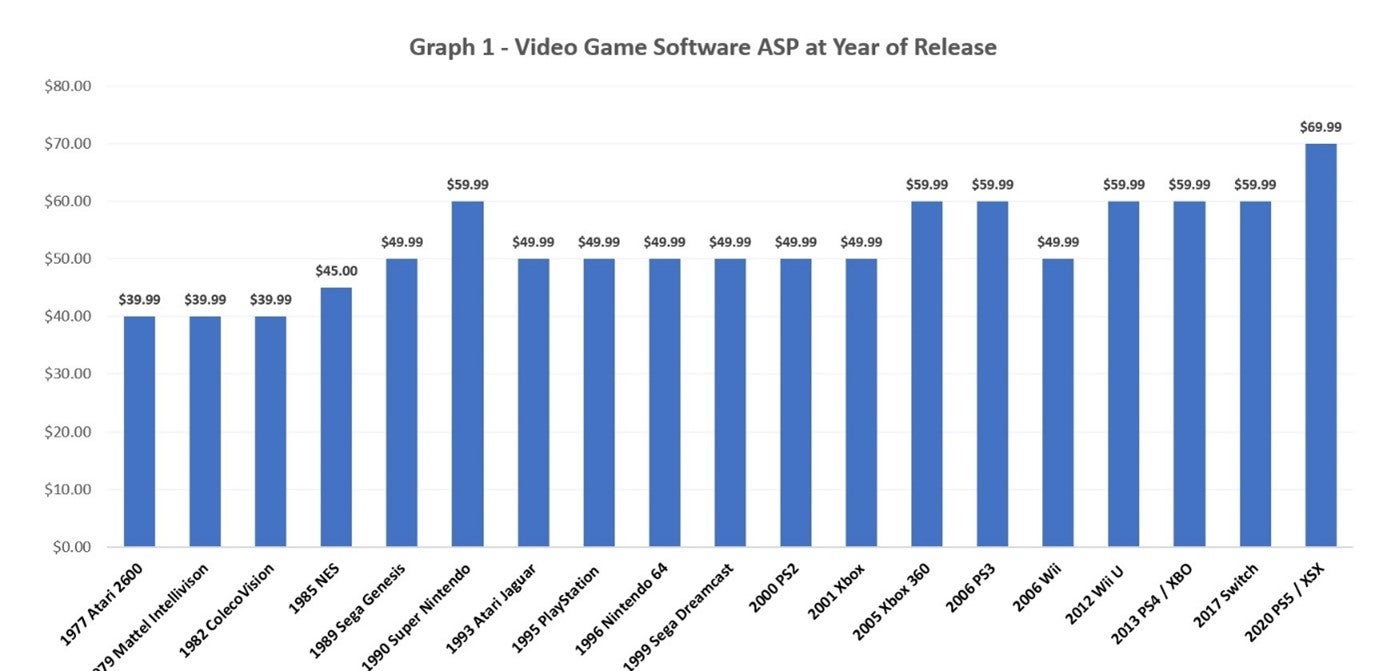

Thanks to an article by Robert Grosso for TechRaptor, we can measure how much new console games have been priced over time. Below are my charts based on that analysis.

Over time, the price of new games has increased on a cycle of approximately 5 to 7 years, as shown in Chart 1. The price increase seems to occur during significant upgrades in the console’s lifecycle (such as when game technology moved to new graphical improvements or when optical drives are added). For example, between 1993 and 2001, the average cost for a new console game was $49.99, but in 2005 with the release of the Xbox 360 and PS3, it rose to $59.99.

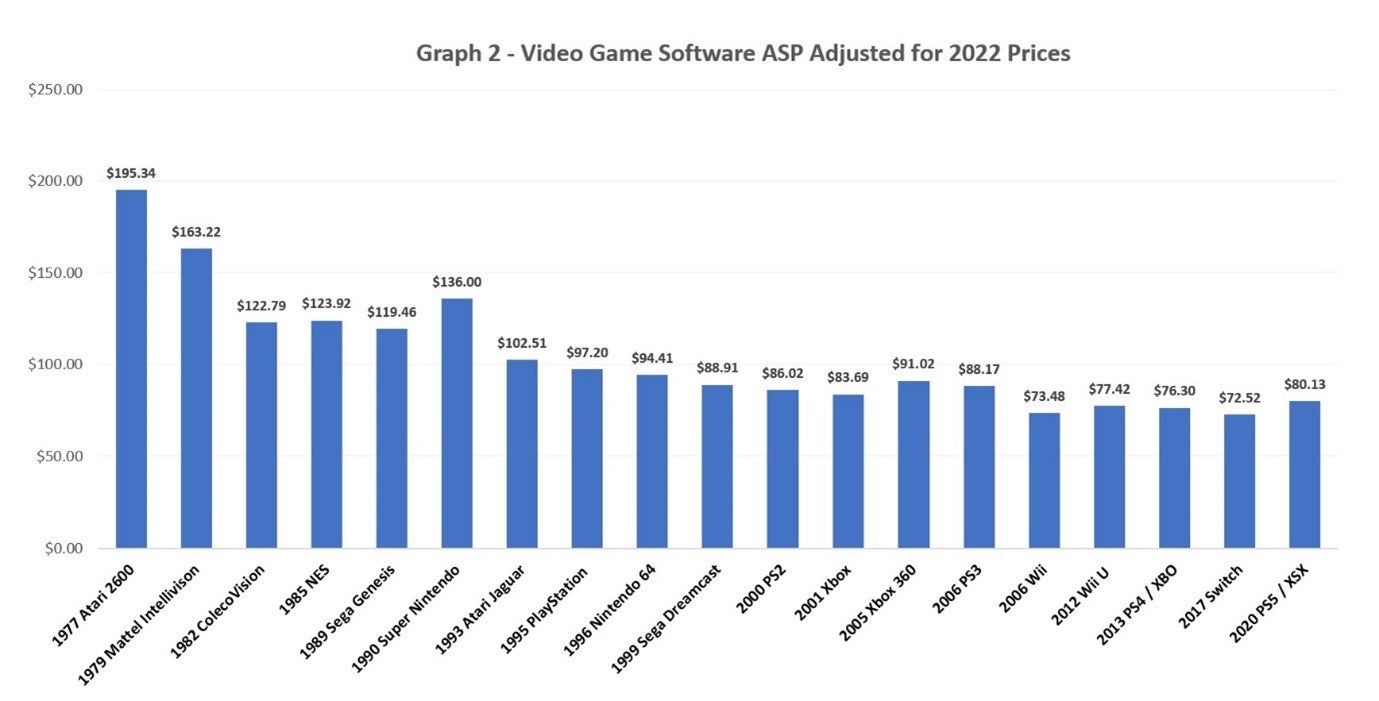

It is clear that prices have increased over time. We might expect this given the prowess of modern consoles, the cost of making games and the pace of naturally ramping up inflation. Chart 2 shows the same release prices, but adjusted for the 2022 price equivalent, using a US inflation calculator.

This means that a 1977 Atari 2600 game would sell for just under $200 today. As time goes on, the price of games drops relatively. Games for the Xbox One and PS4 that sold for $59.99 in 2013 would sell for $76.30 today if game publishers followed inflationary pressures. Even the $69.99 games released in 2020 would cost $80.13 today (if game prices were kept at a constant rate with inflation). That is an increase of 14%.

This means that while the average price of new video games has risen in absolute terms, they have become cheaper over the years in relative terms. Between 1977 and 2020, the average relative price of games fell by almost 2% per year.

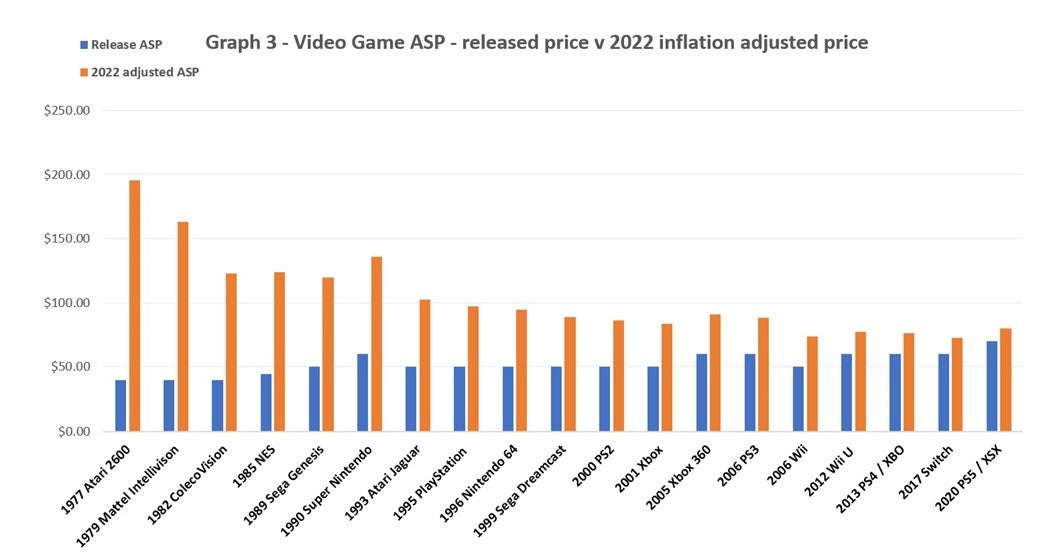

Chart 3 shows these two prices, the absolute and the relative, side by side.

If the price of new games before 2022 were adjusted, new games for the 1977 Atari 2600 would be four times more expensive, new games for the 1993 Atari Jaguar would now be twice as expensive, and new games for the Xbox 360 and PS3 would be 50% more expensive if released today. The relative price curve starts to get shallow around the 1990s and gets closer and closer with absolute prices by the time we reach the 2020 consoles, Xbox series and PS5. This implies that technological improvements in game creation, economies of scale, efficiency and cheaper production values were most felt four decades ago. The good news is that the trend is downward.

Aside from commodities and energy supplies, incremental price increases of everyday products (and services sold) keep their price for years on end. This helps predict costs of good production, consumer demand and investment planning. Especially in times of high inflation, this sense of security can be undermined. Full game customers generally know the price of a new game before purchasing it, and publishers are reluctant to charge higher prices for their manufacturer’s recommended retail price because of this unspoken bond with their customers. Inflationary pressures on game production costs are absorbed for years until the price of new games has to rise to meet this economic reality.

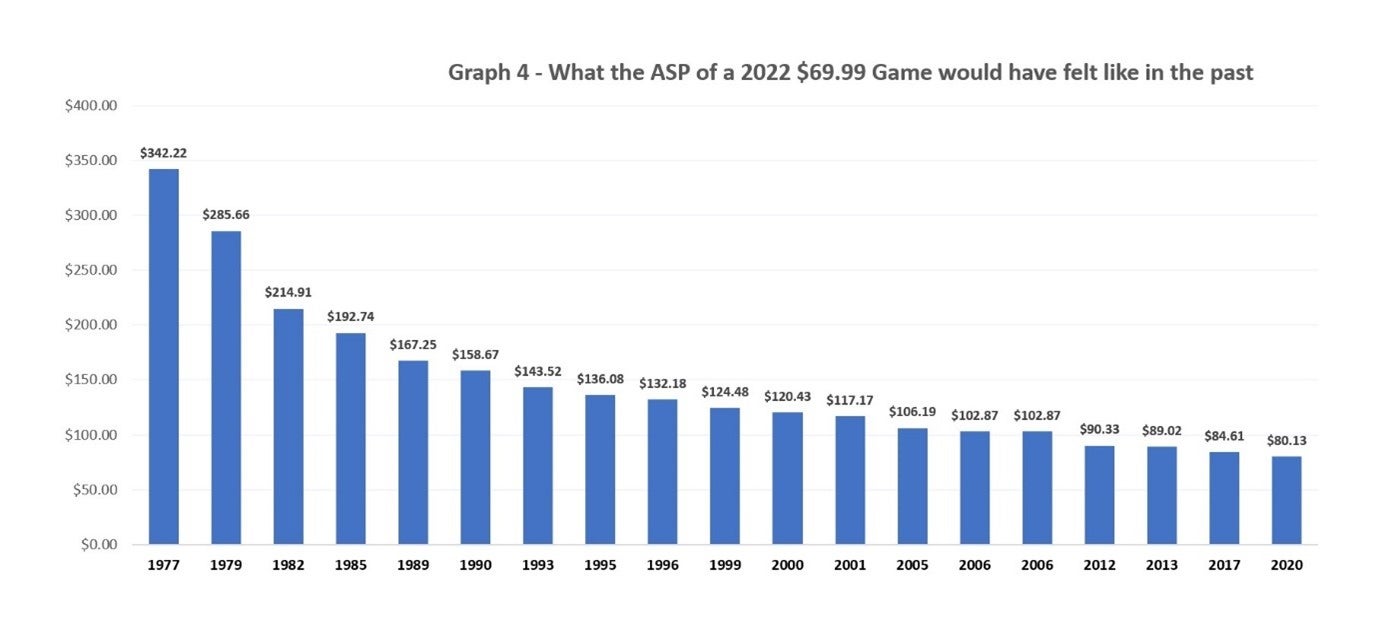

The price for new Xbox Series and PS5 games (AAA games) is $69.99 today. Let’s assume this was based on the calculation that these prices meet the best operating costs, generate money for the publishers, and are the optimal price for the demand forecast. Let’s assume the $69.99 is the “most efficient” price for selling new games. As a fun exercise, let’s work backwards and see how much that would have been in the past.

Chart 4 illustrates how a $69.99 game today would have felt in the past.

In 1977, a $69.99 game would have felt like paying $340 today. It wasn’t until 2012 that new games would have come under the $100 equivalent.

While this is a fun exercise, it strengthens the power of analyzing prices in relative terms and not absolute values. The problem is that people don’t operate or think in “relative terms”, we think in “absolutely”. When prices rise, we assess the new price against the old and assess the level of additional costs for personal wealth. With this human behavior in mind, we find another favorable trend. Absolute prices for all video games also drop over time.

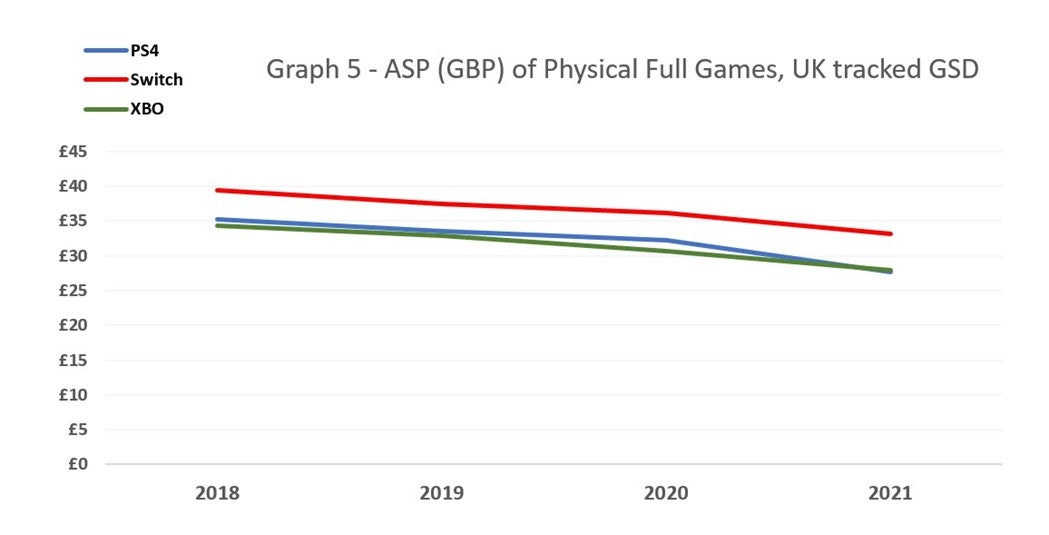

Graph 5 shows the absolute prices for physical full games between 2018 and 2021. The data comes from ISFE’s Games Sales Data, processed by Sparkers, a Belgium-based video game market research firm.

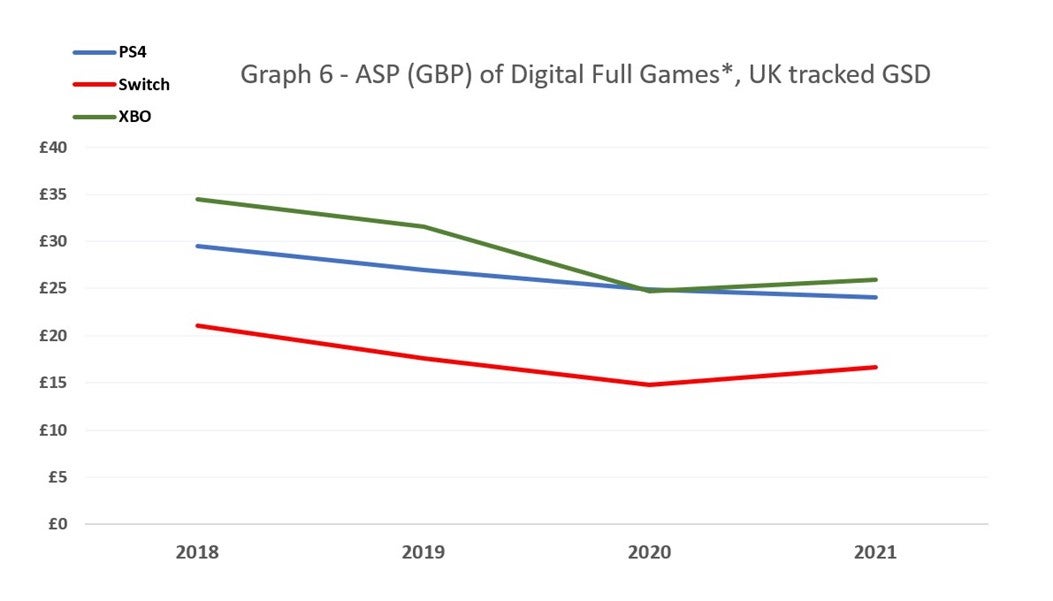

For the Switch, PS4 and Xbox One, all three consoles saw the price of games drop. There are many reasons for this, for example, cheaper catalog games are being sold more and more and as new consoles from the PS5 and Xbox series hit the market, the demand for new games for the older systems decreased. Taking these factors into consideration, this does not alter the fact that the trend in average prices is in one direction, namely downwards. This phenomenon was also seen in digital full game prices, as shown in Chart 6.

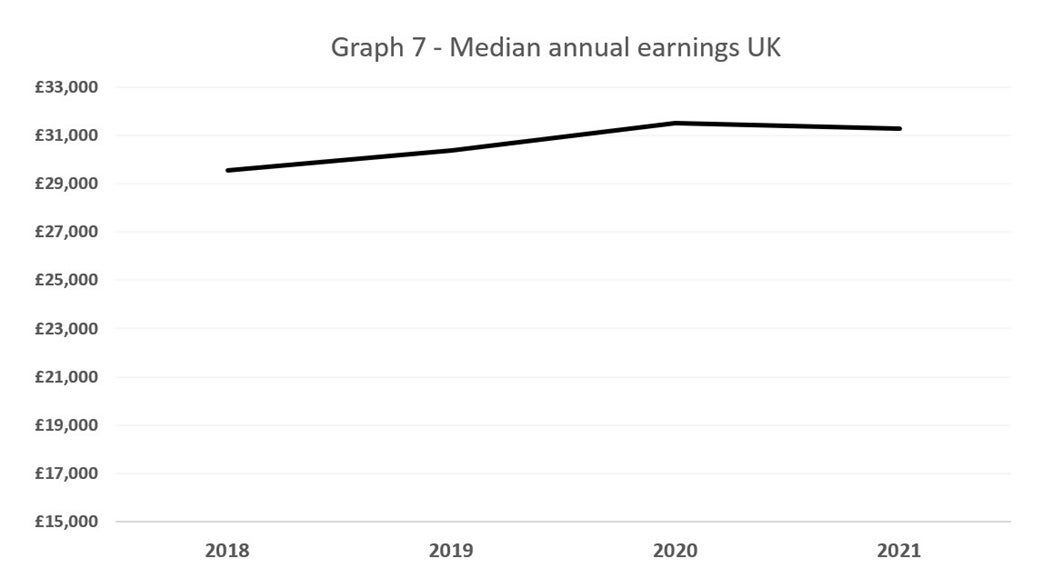

To make matters even more favorable, average annual labor income in the UK increased at a CAGR of +1.9% between 2018 and 2021 (see Chart 7). In contrast, the combined physical and digital (excluding first-party Nintendo games) average price for the Switch, PS4, and Xbox One games fell by a negative CAGR of -6.4%. As people got richer, the game prices should have felt cheaper by comparison.

So, what does all this mean given what is happening with today’s high inflation? For many consumers, games still feel expensive, even if they are more affordable, because of the sense of “value” they afford.

Where gamers once paid $60, they are now being asked to pay $70 for what is arguably the same game, both graphically and in terms of gameplay. It also doesn’t help that social media pressures gamers to buy games on day one, video game publishers record record profits, many of the games come with additional DLC or microtransaction spend, and free-to-play games can pay for something that feels like standing high.

It would be a brave publisher if they raised their MSRP to above $69.99 for new games (for the Xbox series or PS5), but that’s not to say it won’t, especially if inflation persists in a year’s time. is high. It would be safer for publishers to increase the prices for games with the launch of a new console as opposed to a mid-life price increase, but given everything that is happening today, nothing is a certainty anymore.

I close the article on an optimistic note. Some economists predict that the worst inflationary pressures are behind us, let’s hope for all of us they’re right.

To learn more about Sparkers and GSD and how they can help you with video game analysis, visit the sparkers.com website or contact info@sparkers.com.

0 Comments