JAKKS Pacific has Christmas shopping 2022 Tailwind FG Trade/E+ via Getty Images

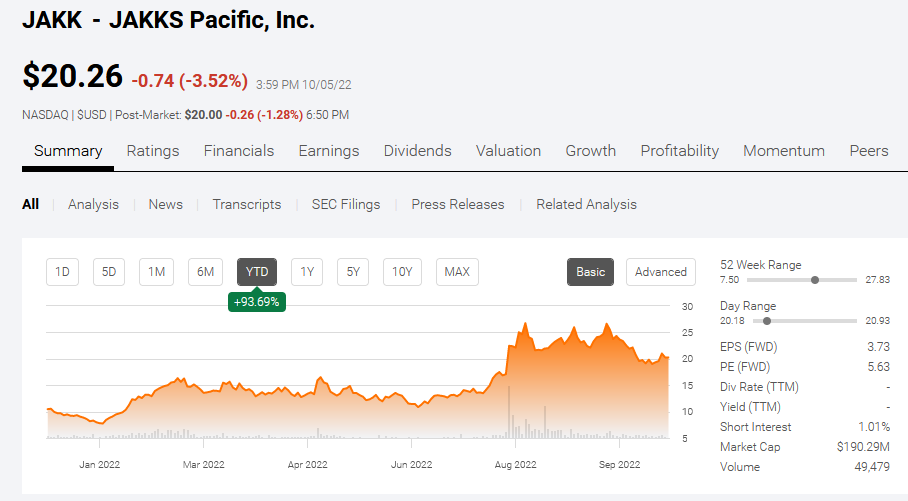

After the September 12th euphoria that JAKKS Pacific, Inc. (NASDAQ:JAKK) a 52-week high of $27.83, is now trading below $20.50. The 25% drop means many are likely profit taking. I think this trend could continue in the coming weeks. Despite these earnings declines, JAKK’s YTD earnings are still at +93.69%. It is probably wise to cash in on the huge YTD gains.

Search alpha

My opposite opinion is that on JAKK you should be average. This toy-focused company could bounce back to $27 due to the upcoming Christmas shopping season. Parents and godparents will spend a lot of money on toys to make their beloved children happy.

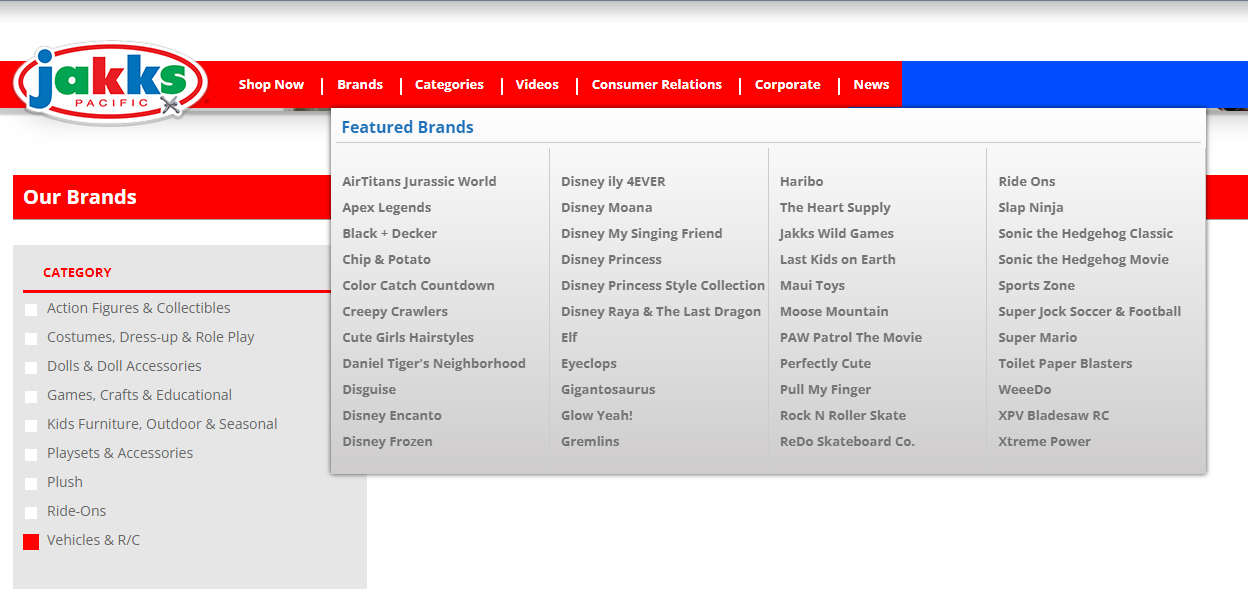

According to the World Bank, there are approximately 1.98 billion children aged 14 and under. Christmas is a huge sales booster for JAKKS Pacific’s diverse set of toy/entertainment products.

JAKKSdotCom

Christmas shopping catalyst

This Christmas wind could help JAKKS wrap up Q4 2022 with $250 million in revenue. Shares of JAKK were up +40% as it posted new revenue of $220 million in the second quarter, +96% year over year. JAKKS Pacific will report its Q3 figures at the end of October. A big hit on sales could help the stock bounce back above $25.

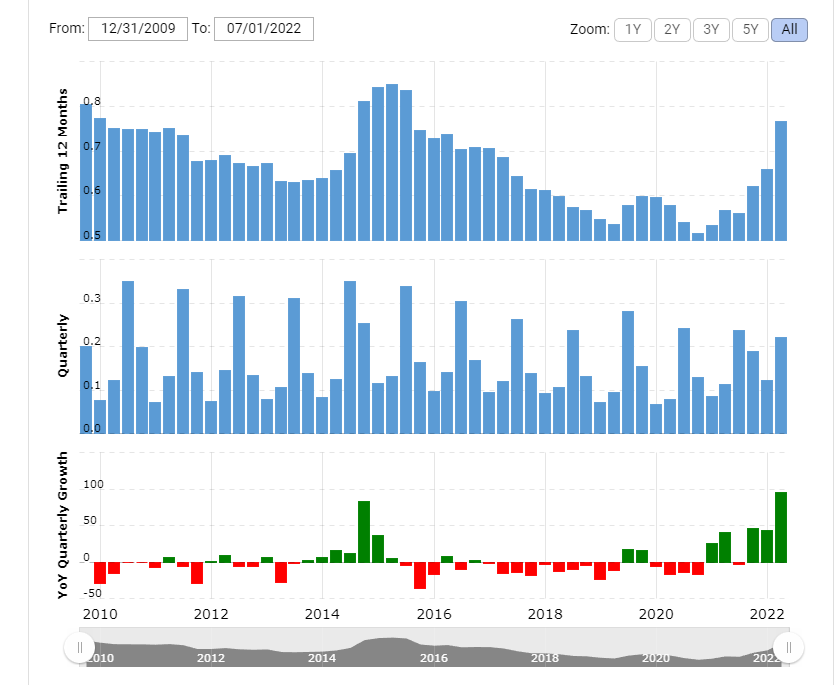

Based on the chart below, JAKK has a big change in delivering revenue growth for Q3 and Q4 2022. The upward pattern is clear. The sale of toys and other related products is benefiting from the post-COVID tailwind.

MacroTrendsDotNet

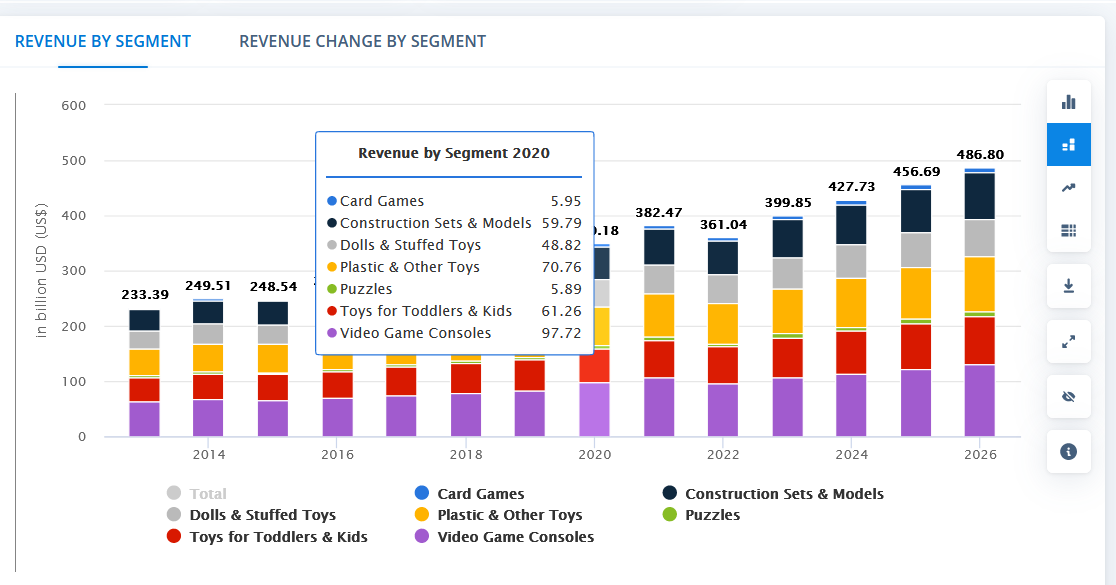

Deloitte estimates that retail sales for the holiday season will reach $1.45 trillion to $1.47 trillion in 2022 (November to January). The toys and related products are valued at $361.04 billion. The tradition of gift-giving means that $361 billion is likely to be generated in the period from October to December.

Statista Premium

More often than not, stronger quarterly sales ultimately lead to higher earnings per share. Thanks to Santa Claus, JAKK was able to achieve a fourth quarter earnings per share of $3.15 or higher. JAKK’s journey back to the top $25 could be faster if it delivers consistent earnings per share growth while driving sales.

Relative undervaluation must be exploited

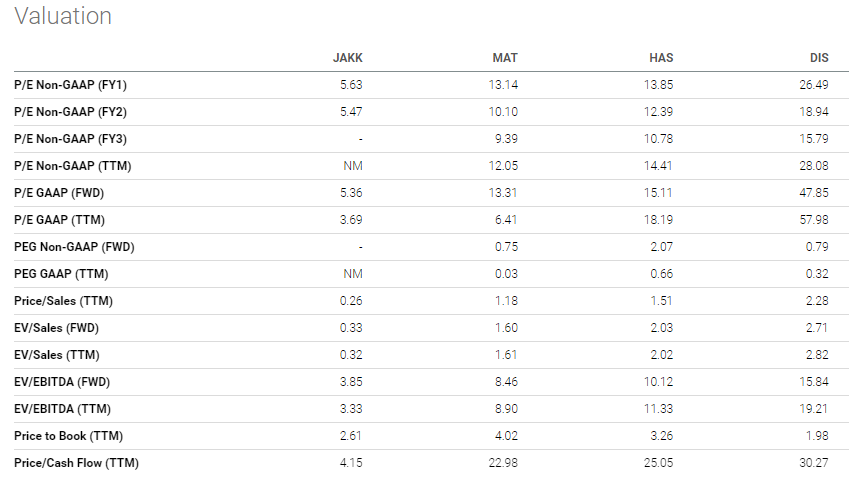

It is easy to take profits on JAKK while still trading above $20. On the other hand, it can also be profitable to lower JAKK. The 25% discount has exacerbated its relative undervaluation relative to its competitors. There is a prevailing market bias against JAKK Pacific. It is a golden opportunity to go long on JAKK, as the stock market only gives it a TTM GAAP P/E valuation of 3.69x.

Looking for Alpha Premium

Small as it is, JAKK deserves more respect from the investing public. Like its much bigger rivals, Mattel (MAT) and Hasbro (HAS), JAKK’s core business is selling toys to boys and girls. It is a market deviation that JAKK’s TTM Price/Sales Valuation is only 0.26x. This is significantly lower than MAT’s 1.61x and HAS’s 1.51x.

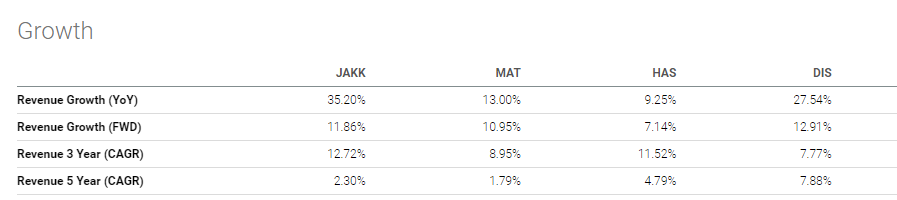

This gross underestimation is unjustified. JAKKS Pacific actually posts a better revenue CAGR than Mattel or Hasbro. JAKK’s TTM revenue CAGR is 35.20%, much higher than MAT’s 13% and HAS’s 9.25%. Smaller companies always have better growth potential than their larger, growing counterparts.

Looking for Alpha Premium

The most important rule when evaluating a stock is to see if it has a tangible improvement in its growth performance. As can be seen from the chart above, JAKK’s management was able to improve its 5-year average revenue CAGR of 2.30%. The estimated forward CAGR of 11.86% could be surpassed. JAKK’s publishing house just needs to license more IPs of famous video games.

Licensing and monetizing the most profitable video games

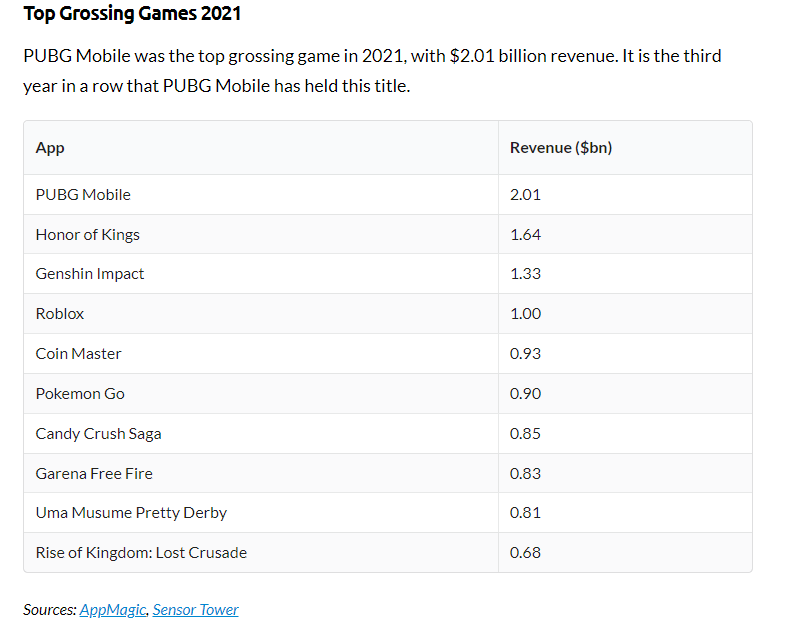

JAKKS Pacific benefits from making Apex Legends action figures, accessories and replica weapons. More investors can go long on JAKK if it also starts selling the same products under the brand name PUBG, Roblox, Valorant and Mobile Legends: Bang Bang.

Adults and children who spend money on hero skins from Valorant or Mobile Legends are ideal targets for JAKKS-made action figures and plush toys. By licensing the toys/accessories/costumes of the world’s most profitable video games, JAKKS Pacific can achieve annual sales of $1 billion or more.

The potential revenue from the sale of plush toys and action figures/weapon replicas to gamers is huge. Refer to the chart below, gamers spent $2.01 billion on PUBG mobile. Some of those paying players could afford JAKKS-made $49.99 replica versions of the most popular weapons on PUBG Mobile.

BusinessofAppsDotCom

JAKK’s need to beat that projected future revenue CAGR of 11.86%. Going big on video game themed toys, accessories, and costumes is an easy long-term expansion strategy.

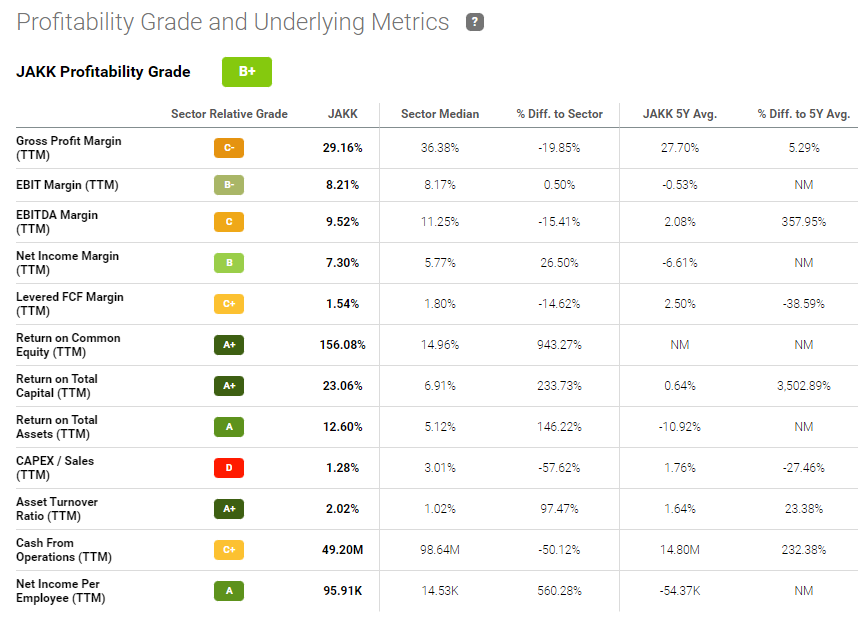

Making and selling toys for the big spenders of the video game industry could lead to better profitability. It is JAKK’s downside risk. Selling toys is a low-margin business. Seeking Alpha’s quantitative rating algorithm gives JAKK a profitability rate of B+. This is because JAKKS Pacific’s TTM net income margin of 7.30% is already 26% higher than the 5.77% average in the consumer discretionary sector.

Looking for Alpha Premium

If you don’t like the low-margin handicap of the toy industry, you may want to look for other stocks to buy. Going forward, JAKK is unlikely to achieve double-digit net profit margins.

Final Thoughts

JAKK’s investment quality is better if its brand partners are not just Disney (DIS) and Apex Legends. Strong pressure to license and monetize the most profitable video games could be a strong catalyst for JAKKS Pacific.

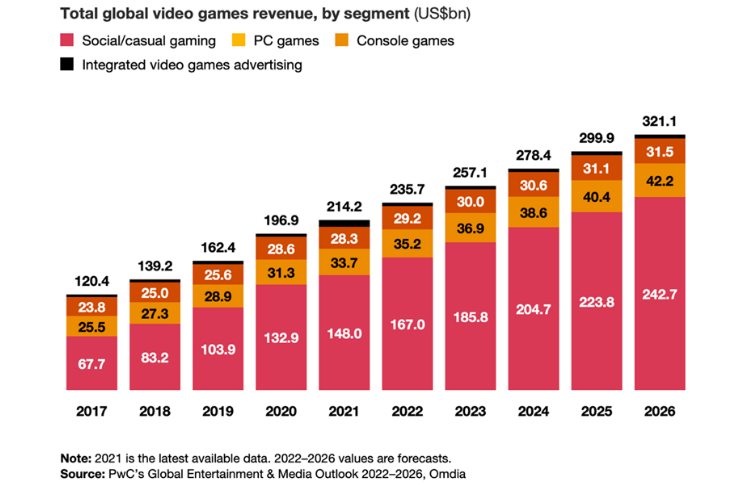

The global video game industry is huge. People will spend $235.7 billion on video games this year. JAKK’s toy-focused wagon is to be paired with the fast-rising video game star.

PwCdotCom

JAKK is a buy because some adults still buy and collect toys. JAKKS-branded PUBG weapons or Roblox action figures will appeal to high-spending gamers regardless of age.

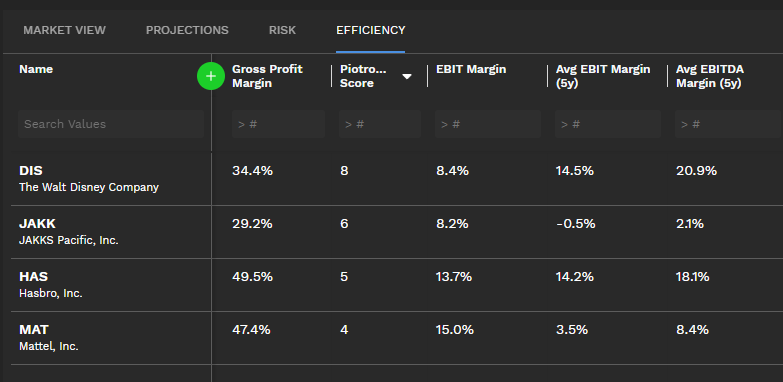

In terms of efficiency, JAKK scores a Piotroski score of 6.0, higher than Mattel’s 4 and Hasbro’s 5. JAKKS Pacific is a worthwhile investment that happens to be efficient in its chosen industry.

Finbox Premium

The most compelling reason to go long on JAKK is its clear potential as a future takeover target. Mattel could add $766 million to its $5.45 billion annual revenue if it buys JAKKS Pacific. I think JAKK’s 0.25x price/sale value makes it an easy takeover target. JAKK’s current market cap is less than $200 million. Disney has nearly $13 billion in cash. It can also brand JAKKS Pacific as an affordable acquisition option in my opinion.

0 Comments