The website of the European Commission’s Directorate-General for Competition (DG COMP) now lists the $68.7 billion Microsoft-ActivisionBlizzard merger under case number M.10646. According to the regulator’s website, the formal notification was made today. Those who have previously been involved in (or closely monitor) EU merger assessments know that informal talks between the Commission and the parties to such a deal start much earlier.

In accordance with EU rules (Council Regulation 139/2004), the provisional deadline for a Phase 1 decision is set for 8 November 2022. What the Commission has to decide at that point is whether to grant accelerated approval or a full assessment (phase 2) which may take several more months. Approximately in the middle of Phase 2, the Commission has to decide whether to issue a Statement of Objections (SO), a preliminary ruling against which a notifying party can defend itself in writing and at a possible hearing. The process can end at any of those times, or any time in between. DG COMP rarely blocks deals. It typically seeks commitments (sometimes more, sometimes less formally) to address potential issues.

In the US, the merger review process is already in the equivalent of EU Stage 2, as in the UK, where I was deeply disappointed to read a decision by the Competition & Markets Authority (CMA) that even included some basic facts and mechanics of the game industry wrong. After that decision, Microsoft had an eight-day deadline to make commitments, which apparently hasn’t happened, so Phase 2 opened in the UK.

Decisions in Australia and New Zealand have been postponed. Saudi Arabia granted fast-track clearance.

The only familiar The complainant is Sony, the undisputed market leader in consoles (and the only platform operator to have a more restrictive policy than Apple in some respects). Seriously, had Sony not been an Epic Games shareholder, it’s quite possible that Epic would have filed antitrust charges against the PlayStation company even before suing Apple. During the Epic vs Apple trial, some Epic internal emails were shown suggesting that at least some people at Epic at one point were even more concerned about Sony’s policies than Epic’s. Now Sony argues that Activision’s Call of Duty is a must-have game to continue to succeed for the PlayStation, but it appears to have patented that opinion, as the public reported versions of several other submissions to the Brazilian antitrust authority CADE that would still be healthy competition in the games industry.

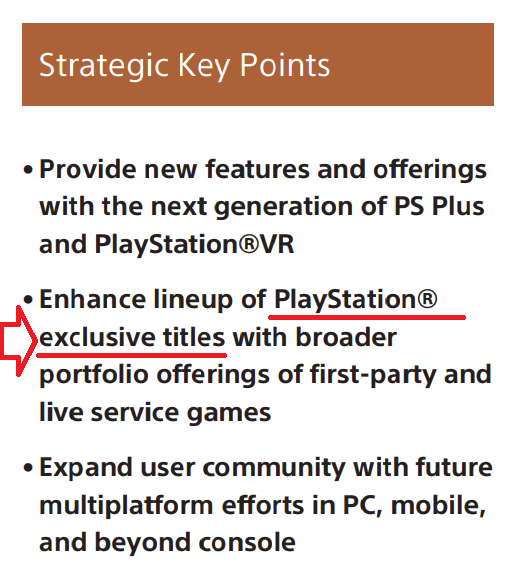

I’d like to highlight something I found in Sony’s 2022 Corporate Report. They emphasize the exclusive (click on the image to enlarge):

Apparently they are projecting their own penchant for exclusive titles onto Microsoft, a company with a clear track record across multiple platforms (example: Minecraft).

Public statements from Microsoft emphasize freedom of choice. There is now a webpage dedicated to the transaction, which links to previous statements, such as one about app store governance.

The idea of a merger being delayed or even blocked in Sony’s wet dreams just because it suits a market leader (PlayStation is #1) frankly turns competition law on its head.

I don’t see any deal-specific issues here. It’s a big deal in terms of transaction volume, but not a “big deal” from a competitive standpoint (as many industry players’ Brazilian submissions show).

Undoubtedly, there has been some negotiation regarding mergers. This week I referred to the testimony of Assistant Attorney General to United States Senate Antitrust Attorney Jonathan Kanter. He promised to take merger control more seriously. When I look at transactions that have been approved and significantly reduced competition, such as Facebook-WhatsApp, I can see where he and other competition enforcers around the world are coming from. As a consumer, I see such issues in several areas (such as US hotel chains). But the mistakes of the past cannot be corrected by going from one extreme (underenforcement) to the other (overenforcement). In any case, there must be justice.

Merger control is indeed an important regulatory function. But as I wrote in the headline, earnings should matter. If a deal is big, or one of the deal parties is a Big Tech company, that means the deal deserves closer look, but doesn’t represent a credible theory of harm in and of itself.

Share with other professionals on LinkedIn:

0 Comments