Reliance Jio, which disrupted the telecom industry six years ago and quickly took over the top spot, has an Achilles heel: lack of high-spend users.

Mukesh Ambani, Asia’s second richest person, is trying to address that when the carrier starts delivering 5G services later this year. Reliance was the only airline to acquire expensive spectrum in the 700MHz band by spending nearly 40,000 crore rupees in an auction earlier this year, when no other rival thought the airwaves were worth the money.

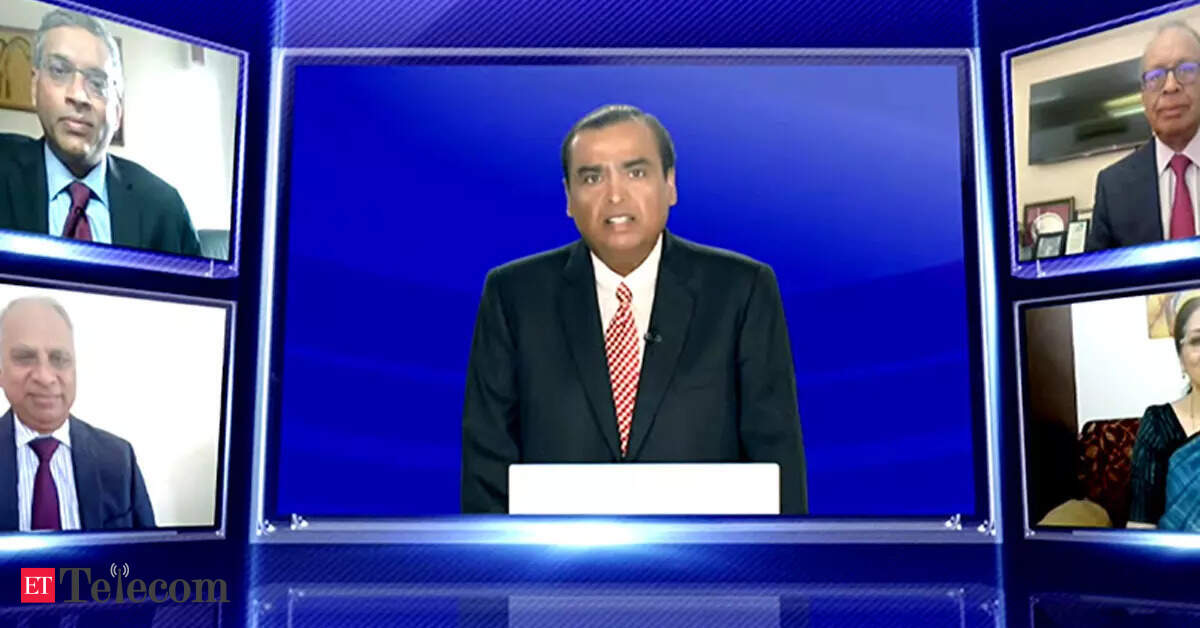

Addressing shareholders at Reliance’s annual general meeting, Ambani said Jio 5G will be the world’s largest and most advanced 5G network as the carrier plans to deploy the latest version of 5G called Stand Alone 5G, which will not be dependent on its 4G network. In contrast, rivals are looking at Non Stand Alone 5G, which the tycoon called a “hasty way to nominally claim a 5G launch”.

However, Jio’s main rival Bharti Airtel has said that there is no qualitative difference between 5G over Stand Alone and the Non Stand Alone 5G modes. A lack of ecosystem around Stand Alone mode and rolling out 5G at 700 MHz in combination with the C band (3300-3600 MHz) will be much more expensive. Airtel has also said that Jio was forced to buy the 700MHz band and has no choice but to roll out 5G in its standalone 5G mode, as it does not have enough spectrum in the midband (1800MHz and 2100MHz). -ties).

Some experts point out that India may have become the largest mobile data market in the world, but a simple voice call is still marred by patchy networks and dropped calls. Apart from a seamless data experience for gaming, entertainment and other services on 5G, the quality of voice calls, especially in crowded and densely populated areas for premium users, will improve significantly, giving Jio an edge over its competitors.

“The differentiator was 700 MHz,” said Aniket Dani, director of CRISIL Research. Adding 700MHz has always been a premium band because it helps telcos reduce tower costs and provides better network coverage. Due to its low frequency and ability to efficiently penetrate buildings, the band offers an edge over telcos in terms of connectivity in congested regions.

The 700 MHz band provides better network coverage due to its low frequency and can penetrate buildings efficiently. This will make it possible to provide better, stable and faster connectivity in densely populated urban areas such as Delhi, Mumbai, Kolkata, etc., experts said.

Jio’s acquisition of the pan-Indian 700MHz band is also aimed at attracting high-end users to its network with the aim of becoming the primary SIM card for them. The driving factor for users with high average revenue per user (ARPU) is a better in-home call quality offering and a differentiated 5G offering. Jio is partnering with Google to develop an ultra-low cost 5G smartphone that will further enhance the offering of the largest telecom player.

Standalone 5G vs Non-standalone 5G

However, carriers doubt that a self-contained 5G network will give them the right return on investment and the costs will be significantly higher. Gopal Vittal, CEO of Bharti Airtel, recently said that a standalone 5G network would increase the cost per GB by almost 50%, while highlighting the lack of device ecosystem.

Jio was forced to buy the 700MHz band and has no choice but to roll out 5G in its standalone 5G mode, as it lacks sufficient spectrum in the midband (1800MHz and 2100MHz bands), said Airtel.

Jio is betting that a standalone network with its 700 MHz band will provide a better consumer experience, which could lead to increased market share and lower network operating costs. It also has long-term benefits, such as a superior quality 5G experience with ultra-low latency and a differentiated and wider range of applications, especially for the core business segment.

While the second largest player (read Airtel) has enough spectrum in the mid-band (1,800MHz and 2,100MHz) to launch a robust non-standalone network on a 4G core, the top player has a less mid-band. band spectrum compared to the second largest player. Therefore, in order to compete, the top player has preferred the 700MHz band that requires stand-alone deployment of 5G, Dani said.

For Jio, a launch in sub-GHz bands will provide a better consumer experience, which could lead to increased market share and lower network operating costs. It also has long-term benefits, such as a superior quality 5G experience with ultra-low latency and a differentiated and wider range of applications, especially for the core business segment.

This could help the company strip high-end customers (a hitch) from its competitors — likely increasing competition at the high-end, BoFA Securities analysts said.

It also costs less to offer broadband services in the 700 MHz band compared to, for example, the 2100 MHz band. A sub-GHz band – bands below 1000 MHz – provides better coverage with speed without consuming a lot of power.

700 MHz is among the lowest frequency 5G bands, while 4G frequencies are typically between 700 and 2500 MHz.

“700 Mhz provides good indoor coverage and therefore Jio will have an edge and attract high-end mobile users, giving competition to rivals,” said a senior technology expert. “Premium users moving to 5G will enjoy seamless voice services as capacity will initially be empty.”

Mahesh Uppal, a telecom expert, said Jio and Airtel will be placed in the same way in the near term as the demand and availability of the 5G service will be limited to business customers.

In the long run, however, Jio will have an advantage as an early mover in using the 700 MHz spectrum, which provides much greater range for signal propagation and requires fewer towers and consequently costs less, he said.

High-frequency bands offer faster speeds, but are limited by a smaller coverage area. Conversely, low-frequency bands offer relatively slower speeds, but a larger area of coverage. Simply put, while a 700MHz will be able to penetrate denser walls and buildings, it will not be able to provide speed in Gbps and while high frequency bands will provide 5-10 Gbps speeds, they will be impeded by trees, dense buildings, etc. limiting coverage.

“For a massive rollout to subscribers, the 700MHz band remains an ideal band in a country like India and could help gain market share early on,” said Dani.

Jio will launch 5G services in key cities including metro cities through Diwali with gradual expansion month by month and by the end of December 2023 every part of the country will be covered by Jio 5G. It has announced an investment of Rs 2 lakh crore to build Jio 5G.

Airtel, on the other hand, is launching 5G in Non Stand Alone mode. Airtel also plans to launch 5G services, starting with key cities and will cover all cities and key rural areas by March next year, from October. The company believes that its higher-quality customer base will adopt 5G devices in the country at a rapid pace and its existing spectrum of spectrum is already the best in the industry, meaning it won’t have to spend a material sum of spectrum for years to come. to give. Airtel will spend much less capex than Jio to launch 5G. And for Airtel, there is always an option to go for Standalone 5G once the ecosystem is fully developed and 5G revenues start trickling in.

Crisil Research expects private players to spend between this fiscal and the next Rs 3-5 lakh crore, with the top player spending around Rs 2 lakh crore. That’s roughly the amount spent on 4G between fiscal 2016 and 2019 — this time squeezed into just two fiscal states, indicating a rush to capture market share early.

The 700 MHz band for 5G is also in the spotlight worldwide.

TPG Telecom has successfully rolled out its 5G standalone 700MHz band services in Australia to reach 85% of the Australian population. KDDI (Japan) began rolling out 5G 700MHz in March 2021, aiming to provide an enhanced 5G experience by improving indoor and outdoor coverage. However, the main implementation in 2021 will come from China, China Broadcasting Network (CBN) and China Mobile are building more than 480,000 5G base stations in the 700 MHz band. Still, stand-alone deployment accounts for about 10% of all global 5G deployments, mainly due to the lack of an ecosystem, experts say.

CHALLENGES

Speeds and the lack of an ecosystem around 700 MHz could act as hurdles for the next 1-2 years.

While 5G Stand Alone still lags behind in terms of handsets, equipment and applications, Jio is better placed than its competitors to offer differentiated service, experts say.

In the 700 MHz band, speed is compromised. During test runs, while the top 5G speed of players on mid (3300 MHz) and high (26 GHz) bands was 5-10 Gbps, it dropped to just over 300 Mbps on a low band like 700 MHz, according to a Crisil research report. .

“When we say that the 700 MHz band is slower, it doesn’t mean it affects consumers in any way. The speed in 4G is usually below 100 Mbps. Recently, a speed of 300 Mbps was achieved for 5G on the 700 MHz band. Therefore, it does not really affect the daily activities of consumers, such as the consumption of entertainment, work and education,” Dani said.

However, the success of 5G will depend on early implementation across India, tackling roadblocks such as low fiber, affordability and sticky legacy users.

Insufficient number of use cases in 5G still remains a concern. India has a good and affordable smartwatch ecosystem that is likely to benefit from the 5G services. However, advanced applications of IoT, such as smart cars at affordable prices, remain a long way off.

“The penetration of 5G depends on the availability of a developed and affordable ecosystem. Premium offerings like the consumption of immersive content i.e. virtual reality (VR) and augmented reality (AR) and the metaverse itself is at an emerging stage in India with high-end VR headset priced between Rs 2,500 to more than one lakh rupees. The content available for consumption on VR also remains low,” Dani said.

The lack of an affordable ecosystem is expected to limit the number of robust 5G subscribers in the near term. The top 4G subscribers representing 5-10% of the 4G base will be early adopters of 5G, he said.

Only time will tell who will eventually win the 5G game in India.

0 Comments