JuSun

Skillz (NYSE:SKLZ) once promised an attractive platform for mobile skills competitions, but the business model has not worked. The mobile gaming platform is now adjusting the model to not rely so much on engagement marketing. My investment thesis remains ultra bearish on the stock even at $1 as there is no evidence the model works.

Pain Restructuring

Skillz just reported that Q2 revenue was down an astonishing 22% quarter on quarter and the company lost $61 million in the quarter. Skillz reduced its net loss by 59% from the previous quarter, but its $73 million revenue still struggles to exceed the excessive spending at Skillz.

For the quarter, revenues missed targets by a whopping $19 million. The miss was great for a $93 million goal that came in the quarter and was largely due to a cheating issue where platform participants took advantage of system discounts and friend referrals, among other issues.

The whole problem is that the quality of the game doesn’t seem to sell itself, leading Skillz to aggressively spend money on marketing to acquire and retain customers. The whole premise of the investment was an attractive mobile skill-based gaming platform that should attract players with limited marketing.

For the second quarter, Skillz spent $73 million on total sales and marketing while generating only $73 million in revenue. The company is still unable to generate revenue that exceeds marketing spend, even with marketing cuts.

The problem is that paying users dropped over the quarter. Paying MAUs (monthly active users) fell by 26% qoq to just 0.42 million. The platform remains extremely small and limits any potential scale of the business.

The company is promoting a new metric (always a bad sign) of RAEM (income from engagement marketing), but investors are cautioned not to be fooled by this figure. This statistic dropped to just $43 million in the quarter, down another 16% from $51 million in the previous quarter.

Such a small amount limits the opportunity to make a profit despite a company with almost 90% gross margins. The combined costs for R&D and G&A exceed the total of the new RAEM metric. As long as RAEM continues to fall along with reducing marketing, Skillz is in a race to the bottom, as retention and revenue will only decline with less money spent on marketing.

According to the guideline for 2022, revenues have fallen to $275 million, compared to a previous internal target of $400 million. The goal is for engagement marketing to remain at an unsustainably high level of 42% of revenue, pushing RAEM to just $160 million this year.

As Skillz hit an RAEM of $94 million in the first half of the year, the company forecasts a decline to just $66 million in the second half of the year. The goal is to achieve an average RAEM of $33 million for the remainder of the year. Such a low amount of their revenue stat won isn’t encouraging for the company to hit probability next year.

Product Development Questions

Skillz closed the June quarter with cash of $590 million and net cash of $290 million. The strong financial position gives the company a few years to get things in order.

The company has a promising NFL game challenge entering the soft launch phase and a multi-year partnership with the UFC for a mixed martial arts-branded mobile game. Any successful game launch for a high appeal game can spark the player’s interest to drive engagement without requiring a high level of marketing.

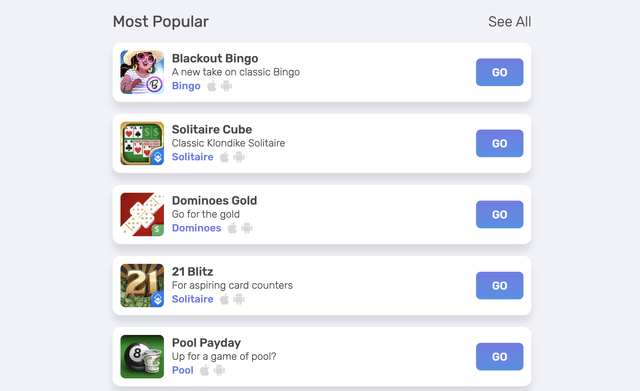

The biggest question remains the quality level of the games on the mobile platform. The most popular games listed on the website still seem very simple games that are clearly unappealing to the average player based on the consistently weak financial numbers.

Source: Skillz.com

According to the CEO of the Q2’22 earnings call, Skillz has major product development issues as follows:

In fact, we’ve had a slower product development rate than we would have liked or expected. We’ve had too many new product features that don’t boost LTV and are sometimes even harmful. We’ve broken down too many new experiments that didn’t yield LTV growth and were sometimes harmful as well.

To take off

The main conclusion for investors is that Skillz remains in a downward spiral. The company has long promised higher quality games, but the end result is product development issues and retention engagement cheating. The mobile skills-based gaming opportunity remains interesting, but Skillz doesn’t seem to have the talent to execute a promising business plan.

0 Comments