There’s a sense of crushing inevitability in the recent Nvidia news. Not just the noise about slowed down next-gen GPUs, or constantly changing leaked specs (opens in new tab)but the drastic drop in game revenue (opens in new tab). That and the fact that it’s now sitting on over $1 billion worth of last-generation graphics cards could really do with a shift ahead of the launch of its new GPUs.

I mean, we all kind of knew it was going to happen; as the mustache and eyebrow hair matching poster boy himself once said, history doesn’t repeat itself, but it often rhymes.

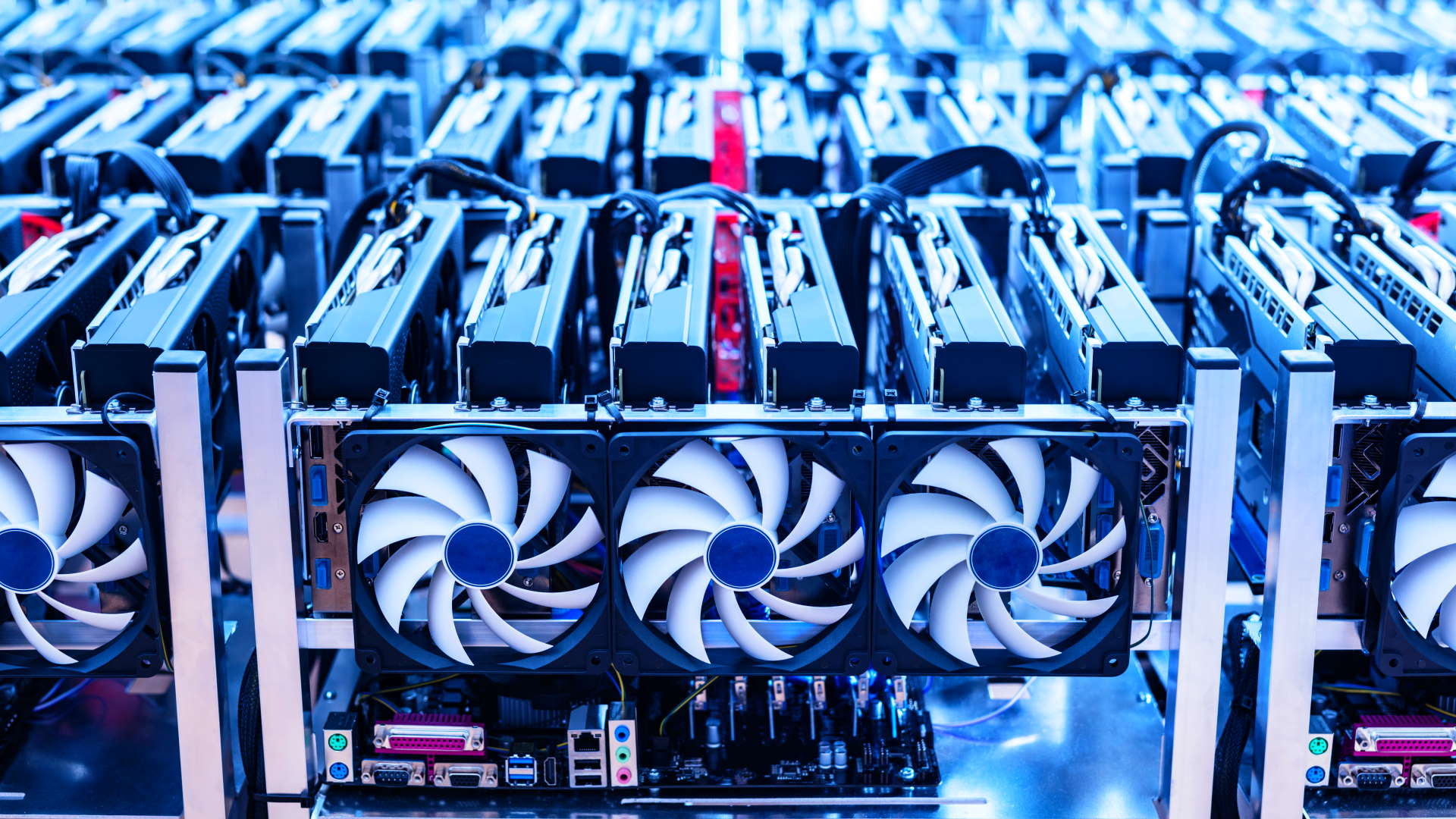

Cryptocurrency mining has made it virtually impossible for the past 12-18 months to buy a new graphics card, with nearly every new GPU coming off the production line going to mining rigs around the world. But the crypto bubble has now burst, with bitcoin’s benchmark value crashing and the ethereum network going over the proof-of-stake model soon, rendering those expensive GPU mining companies all but obsolete. (opens in new tab).

And so, after Nvidia took all possible leverage to increase its graphics card supply when demand was at an all-time high, it now has about $1.32 billion in inventory that needs to be transacted before it gets its value. . next-gen GPUs out the door.

If we get more than one new RTX 40 series graphics card this year, we might consider ourselves lucky.

Which means the new GeForce series of graphics cards has seemingly slowed down (opens in new tab)potentially with fewer new cards coming out this year, and the regular launches could potentially be delayed indefinitely.

That’s an intro that could have been ripped out of almost everything I wrote in 2018 (opens in new tab). But then at least we went to Gamescom and came out on the other side with the RTX 2080 Ti, RTX 2080 and RTX 2070. Finally three separate Turing GPUs for gamers. If we get more than one new RTX 40 series graphics card this year we may consider ourselves lucky.

And there will be a lot of consternation about Nvidia’s delaying of new gamer toys, as well as concerns from investors and city dwellers about more than $1 billion in lost revenue in the last quarter compared to targets. But it was inevitable, and frankly probably inevitable.

Nvidia blames a massive drop in gaming revenue for the missed targets, with numbers down 44% this quarter compared to the previous quarter. But that is not it For real blame pesky gamers and their fickle desire for new GPUs, as all of Nvidia’s crypto sales are also packed into the “gaming” department.

Sure, the green team made some special mining cards, but they barely scratched the surface of the crypto GPU bubble.

And now that massive amounts of crypto card sales have dried up, gaming revenues have dwindled. Cryptocurrency volatility meant that another crash, similar to the one of 2018, was always likely, but as the main supplier of GPUs to the crypto mining market, Nvidia had no choice but to put its offerings into overdrive to back it up.

There may be an economics and supply chain genius with the perfect formulas to ensure solid production during such a period of soaring demand without the risk of eventual oversaturation, but I am not, and I am pretty sure they don’t work with Nvidia either.

dr. Thomas Goldsby called what the pandemic did to the supply chain a “Black Swan Event, (opens in new tab)something unprecedented that the manufacturing networks struggled with. But crypto was different, something of a familiar phenomenon, yet irresistible.

The only chance Nvidia had to try and get cards to gamers was to ramp up production, but it also had a responsibility to shareholders to take advantage of the huge financial opportunities presented by the latest mining boom. A capitalist society demands this; choosing to keep production at a point where it wouldn’t satisfy gamers and miners would have served no one and left investors so frustrated that they would question the company’s leadership.

But no one really knew when the bubble would burst, only that it most likely would. And with supply chain and chip manufacturing agreements necessarily spanning long timescales, Nvidia couldn’t just pull the plug once the price of bitcoin fell off a cliff or when the eth-org published the expected date for switching to proof-of-stake. (opens in new tab). Indeed, Nvidia is reportedly still locked into significant GPU manufacturing contracts with Samsung for last-generation chips, which it had to fulfill.

What about AMD in all of this? Sure, some of its RDNA 2 GPUs were used for mining, but Nvidia’s Ampere cards had that mix of mining performance and increased availability, making them much more desirable.

So from my perspective, Nvidia had no choice but to follow this path, knowing that it would in all likelihood lead to an eventual oversupply at the end of the current boom/bust cycle. But it’s what the company is doing now that will be important, and this is what it can control.

Nvidia does not operate in a vacuum and some of its decisions will be made by the competition.

We’ve already heard rumors that it has now postponed the launch of its next-gen Lovelace GPUs, with the potential to kickstart these next-generation GeForce graphics cards with a flagship RTX 4090 only this year, with the rest pushed to 2023. pushed.

Personally, I think it would be a mistake if it hopes to clear the RTX 30 series stock before the RTX 4080 and RTX 4070 launch. If demand from real gamers is low because a new generation is on the way, slowing down that generation won’t convince them to spend that money on an existing card if they’ve already decided to wait.

They just wait longer.

Perhaps Nvidia is hedging its bets on the pre-built market, hoping to ship current-generation cards to PC builders instead, while holding back the next generation.

However, Nvidia does not operate in a vacuum and some of its decisions will be made by the competition. If AMD launches its RDNA 3 GPUs at a level that can surpass the RTX 30 series in terms of both price and performance, it will pull the rug out from under the current generation, making them much harder to sell anyway.

Now that the crypto bubble has burst, no matter what it decides to do, there will be a hit. But Nvidia must now decide whether to stretch that hit to wipe out existing cards before a delayed launch, or whether it can launch its high-end cards on schedule and adjust the pricing of its oversupply accordingly.

I think I’ve ably demonstrated that I’m not an economics or business guru, but personally I’d be tempted to stick with the next-gen plan, offering discounts to the retailers and AIBs in stock to keep the price of the existing inventory, and just get things sold. Even if it only launches the RTX 4090, RTX 4080 and RTX 4070 this year, the stock of those new cards will be small, and I bet with adjusted prices it can still be sold through much of the excellent latter. generation of GPUs.

Either way, the money would still come in.

But I’m sure there are sensible arguments against that, and the most likely course of action right now would be a lone high-end RTX 4090 launch in October, with possibly an RTX 4080 just before the end of the year on the outside. . And then Jen-Hsun crosses his fingers that people will still be sucking up RTX 30-series cards priced like there’s no next-gen on the horizon.

0 Comments