llast month Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) performed a 20-for-1 stock split. Both in the months before and in the weeks that followed, there has been more discussion among investors about the tech giant. One of the questions being asked is whether Google’s parent company is still a good long-term option for investors?

I think it could be a good bet in the long run – the tech company is experiencing solid growth from its core businesses and its shares are trading at a better price than in the recent past thanks to the 2022 tech selloff. Take a closer look at why investors should consider buying Alphabet’s stock now.

Image source: Getty Images.

The advertising power of Alphabet

Alphabet’s total revenue rose 13% in the most recent quarter (reported July 26) to $69.7 billion. And while that was slower than pandemic-driven revenue growth in 2021, the company is still a revenue-generating machine in a burgeoning advertising market.

The majority of Alphabet’s revenue comes from Google’s advertising activities (including Google Search, YouTube Ads and the Google Network). In the second quarter, this segment’s revenue grew 11.5% year over year to $56.3 billion.

This growth looks even better when you consider that Alphabet has more opportunities to expand in the digital advertising market. According to some estimates, the global advertising market could reach $876 billion by 2026, up from $602 billion this year.

Alphabet is already a leader in the digital advertising space — it takes first place for Metaplatforms, Alibabaand Amazon in the US — and as the market continues to grow, Alphabet has the potential to grow with it.

Alphabet stocks are currently trading at a discount

You may have noticed that the stock market has been a bit volatile lately, with tech stocks in particular suffering. The tech-heavy Nasdaq composite index is down 19.5% since the start of the year and Alphabet’s shares are down about the same amount.

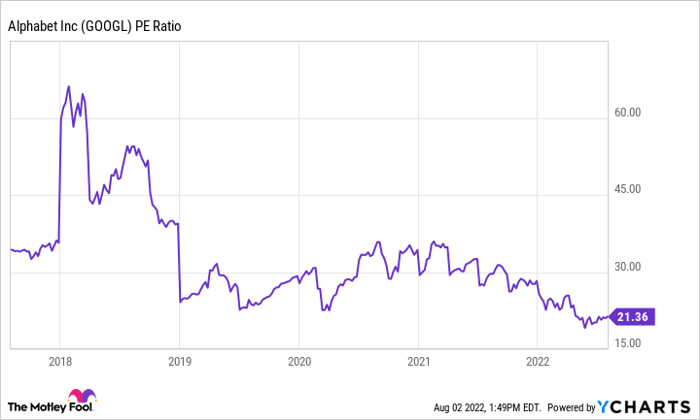

While that short-term drop isn’t great, it does offer long-term investors an opportunity to buy Alphabet’s stock at a relative discount. The chart below shows Alphabet’s P/E ratio over the past few years, with Alphabet’s most recent P/E ratio being much lower than in the recent past.

GOOGL PE Ratio data by YCharts.

When buying a stock, it is obviously preferable to get it at a relative discount. With the tech sector currently flat and Alphabet’s shares falling, investors can buy Alphabet’s shares at a discount.

Alphabet has money to weather an economic storm

It’s important to point out that if the US economy enters a major center, investors shouldn’t worry about Alphabet’s ability to get through it.

Alphabet has a highly profitable business that generated $12.6 billion in free cash flow in the most recent quarter and $65 billion over the subsequent 12 months. The company’s balance sheet is also in very solid shape, with Alphabet closing the quarter with $125 billion in cash and investments.

While no company is immune from recessions, with this money Alphabet could continue to pay its debts while investing in its products and services.

Remember this is a long term game

Over the past month, the tech sector has seen a bit of a rebound, along with Alphabet’s stock. And while that’s good to see, don’t forget that buying Alphabet stock and holding it for at least five years (or longer!) is where long-term investing really pays off.

There will likely be some more volatility in stock prices as investors digest new economic data and investors continue to digest news of inflation and a potential economic slowdown.

But now that Alphabet already has a very strong position in the ad space and the company’s stock is cheaper than it’s been in years, this technology stock still looks set to be a long-term winner.

10 Stocks We Like More Than Alphabet (A Stocks)

When our award-winning team of analysts has a stock tip, it can pay to listen. The newsletter they’ve had for over ten years, Motley Fool Stock Advisorhas tripled the market.*

They just revealed what they think are the top ten stocks investors can buy right now… and Alphabet (A-shares) wasn’t one of them! That’s right – they think these 10 stocks are even better bargains.

View the 10 stocks

*Stock Advisor returns from July 27, 2022

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, serves on the board of directors for The Motley Fool. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on the board of directors of The Motley Fool. Suzanne Frey, an executive at Alphabet, serves on the board of directors of The Motley Fool. Chris Neiger has no position in any of the listed stocks. The Motley Fool holds positions in and recommends Alphabet (A Shares), Alphabet (C Shares), Amazon and Meta Platforms, Inc. at. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

0 Comments